Charitable Trust Q&A

George Atwood, manager of the Life Income Program, answers some frequently asked questions about Yale’s Charitable Trust Program.

Tell us about Yale’s Charitable Trust Program.

Yale serves as trustee of more than 140 charitable remainder trusts with a total market value of

almost $100 million. In the University’s office of Trusts and Estates, we carefully oversee the

administration of the trusts, using BNY Mellon Wealth Management for custody, record keeping,

and preparation of statements and tax returns. We personally direct the investment of each trust,

and as part of the Yale Investments Office, apply the resources and expertise of that office in

managing the trusts’ assets.

My colleagues and I also work closely with the Office of Planned Giving, and as manager of the trust program, I have the pleasure of serving and working with many of Yale’s alumni and friends. This daily interaction with the University’s most generous and enthusiastic supporters is a wonderful part of my job.

How are Yale’s charitable trusts invested?

While they are not invested directly in the Endowment, Yale manages trust investments using

many of the same strategies employed by Chief Investment Officer David Swensen and his group

in stewarding the University’s Endowment. We commingle trust investments in pools which

include the Yale Equity Pool, a diversified portfolio of domestic and foreign stocks, and the Yale

Fixed Income Pool, consisting mostly of government bonds.

When you ask Yale to serve as trustee, we work with you to choose the strategy that best meets your particular investment objectives and risk tolerance. Depending on your goals, we may consider a growth strategy which averages 75% equity and 25% fixed income; a balanced strategy of 50% equity and 50% fixed income; or a more conservative approach comprised of 25% equity and 75% fixed income.

We utilize a number of firms to manage the trust pool assets, many of which are investment managers for the Yale Endowment. This gives individual trusts unique access to firms that typically accept only large institutional portfolios. For example, Grantham, Mayo, Van Otterloo & Company (GMO) of Boston, a well respected institutional investment firm not open to retail investors, is the primary manager for Yale’s Equity Pool.

How have the trusts’ investments performed?

Of course we’re subject to the same market fluctuations and conditions as other investors, but

through disciplined asset allocation and access to top-quality managers, the trust investments

have historically performed very well.

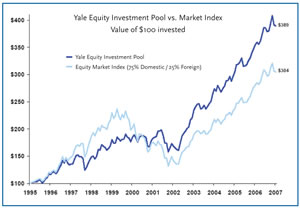

I am particularly proud of our performance through the great technology “dot-com” bubble of 1997–2003. The graph below shows the behavior of our stock portfolio through the bubble, as we passed up some of the excessive rise in technology stocks from 1997–2000, and benefited greatly from a value orientation as the bubble burst in 2000–2002. While global markets suffered significant volatility and decline, the disciplined Yale portfolio experienced a smoother, nearly uninterrupted upward trend.

Yale’s trust stock portfolio from 1995 through 2007 compared to the Equity Market Index comprised of 75% domestic and 25% foreign equities. Click to enlarge.

More recently, our Fixed Income Pool, with a portfolio of simple treasury bonds and treasury inflation protected (TIP) securities, has provided excellent diversification during the current credit upheaval. Over the long run, we have been successful in delivering superior performance that has exceeded market benchmarks with lower volatility. Another important factor, of course, is that Yale’s fees for trust administration are well below those of commercial financial institutions.

Other institutions invest trusts directly in their

endowments, why not Yale?

I hear this question often, since Yale and several

of our peer universities received private

letter rulings from the IRS allowing trusts to

be invested in units of Endowment. While

this opportunity has generated a considerable

amount of interest and may seem like an

attractive option, after a thorough evaluation

of the implications, Yale determined that this

approach may not be in the best interests of

our trust donors and income beneficiaries.

One reason is that the investment horizon of the Endowment is very long term—basically perpetual—while the term of a trust averages 10–25 years. These differing time horizons would dictate different investment strategies in most cases.

Another reason is that since Yale is tax-exempt, the Endowment is invested without regard to tax consequences. Our trust investment pools, on the other hand, are managed for maximum tax-efficiency by limiting taxable short-term gains and favoring low-tax qualified dividends. Under the terms of the letter ruling, all distributions to income beneficiaries from trusts invested in endowment are taxed as ordinary income—at rates as high as 35%. As a result, it could take as many as ten or more years for trust income beneficiaries to achieve similar or better after-tax results from the Endowment returns, compared to the more conventional investment pools Yale currently offers.

Given the negative tax implications, the University’s fiduciary responsibility to its donors, and the robust trust investment options already available, we believe that the best course is to continue to invest Endowment funds and trust assets separately. Rather than using Endowment investment directly, we utilize certain endowment investment strategies for the trusts when they are appropriate based on their risk, term, and tax characteristics.

Why should someone consider Yale as a Trustee?

While you may serve as your own trustee, or

have a bank or brokerage firm manage your

trust, you may want to consider having Yale

serve as the trustee of your charitable remainder

trust. We have a proven track record and offer

excellent financial resources at minimal cost.

Most important, Yale brings a unique alignment

of interests, sharing with you both the risks and

rewards of effective management. As a beneficiary

of the trust, Yale shares a direct interest in

seeing sound, cost effective administration and

investment. When your trust does well, both you

and Yale share in the results.

About George Atwood

Yale’s highly successful charitable trust program is directed by our colleague George Atwood, manager of the Life Income Program. George joined Yale in 1988. He earned a B.A. in economics from Tufts University, and MBA from Yale School of Management, and is a Chartered Financial Analyst.

The success of the University’s planned giving program is dependent in large measure on a collaborative partnership with the Yale Investments Office- in particular with the Trusts and Estates group. One of the responsibilities of the office of Trusts and Estates is the administration of Yale’s Life Income Program, including oversight of the investment and management of approximately 1,000 charitable gift annuity contracts, 370 pooled income fund accounts, and over 140 charitable remainder trusts for which Yale serves as trustee.