Gifts of Business Interests

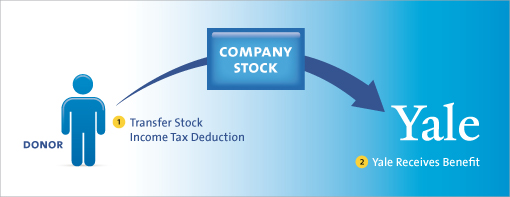

How It Works

- You give shares of closely-held stock to the Yale.

- Yale may hold the shares and collect the dividends, or it may offer the stock back to your company for redemption or re-purchase. Yale will apply dividends or the proceeds to the purposes you wish to support.

Benefits

- You receive gift credit and an immediate income tax deduction for the appraised value of your shares, even if their original value was close to zero.

- You pay no capital gains tax on any appreciation that has taken place in the shares.

- Under certain conditions, you may be able to use closely-held shares to fund a life income arrangement.

- You can make a significant gift that benefits both you and Yale during your lifetime without using your cash reserves to do so.