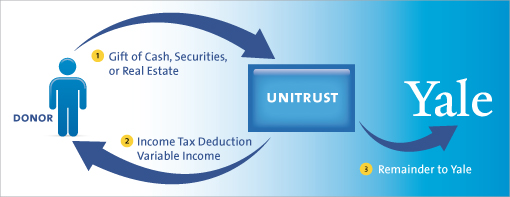

Charitable Remainder Unitrust

How it Works

- You transfer cash, securities or other appreciated property into a trust.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or beneficiary(ies) you name.

- When the trust terminates, the remainder passes to Yale to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no upfront capital gains tax on appreciated assets you donate.

- You can make additional gifts to the trust as your circumstances allow for additional income and tax benefits.